Calculating payroll taxes 2023

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID. Regional employers may be entitled to a 1 discount on the rate until 30 June 2023.

Use Case Diagram For Payroll Management System Use Case Payroll Management

Service stipends are not included when calculating your eligibility for financial aid.

. In calculating net income from the business partners and sole proprietors are not allowed to deduct the following items. Increase the payroll tax rate to 161 up from the current 124 with no changes in the taxable income. H Hold Harmless--If a lender has received the documentation required under this section from an eligible recipient attesting that the eligible recipient has accurately verified the payments for payroll costs payments on covered mortgage obligations payments on covered lease obligations or covered utility payments during covered period.

When using the direct method you also need to account for depreciation of a portion of the house if you own it. Property tax rates are established on yearly basis by municipalities within limits set in the Law on Local Taxes and Fees. For more information on calculating the motor vehicle allowance read the allowances page.

The payroll tax rate reverted to 545 on 1 July 2022. Income Tax weeks tax weeks Tax weeks are periods of 7 days which follow on from each other starting on 6. In 2022 land used for business purposes is subject to a rate limit of PLN 103 per square metre.

Fiscal Year 2023 beginning July 1 2022 is not a leap year. The exempt rate per km used for payroll tax is the ATO prescribed rate for the financial year immediately before the financial year in which the allowance is paid. Just provide their names and Social Security numbers.

Employers and workers typically pay half of the 124 Social Security and 145 Medicare benefit each for a total of 153. When theyre non-citizens though things may be a little more complicated. Wage tax wage withholding tax.

Individuals who are self-employed pay self-employment taxes. Taxes are deducted from service stipends. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023.

Before getting on payroll you must complete several hiring forms including the W-4 for federal taxes and the NC-4 for North Carolina state taxes. The Employers portions of federal and state payroll taxes health insurance premiums retirement plan contributions etc are not part of taxable gross payroll. Tax Return Access.

Cannabis Retailer Excise Tax Beginning January 1 2023 cannabis retailers will be responsible for collecting and paying the cannabis excise tax to the California Department of Tax and Fee Administration CDTFA. Income tax in Australia is imposed by the federal government on the taxable income of individuals and corporations. IRA pension or Section 401k contributions or.

If mistakes are made when calculating or filing payroll taxes they could result in costly penalties. The Departments long-term goal is for a customized approach to verification. For example the 2022 to 2023 tax year starts on 6 April 2022 and ends on 5 April 2023.

Built-in federal and 50 states tax tables. A 15 cannabis excise tax will be applied to gross receipts of cannabis or cannabis products in a retail sale. This is also included when calculating the double holiday pay.

Less payroll tax reduction for your employees Effective date. 22 September 2022. Taxes charges and levies A-Z.

A menu of potential verification items for each award year will be published in the Federal Register and the items to verify for a given application will be selected from that menu and indicated on the SARISIRThose output documents will continue to include only one verification flag to show. State governments have not imposed income taxes since World War IIOn individuals income tax is levied at progressive rates and at one of two rates for corporationsThe income of partnerships and trusts is not taxed directly but is taxed on its. The amount is added to their wages solely for calculating federal income tax withholding.

More information on how the levy will be administered will be available later this year. From 1 January 2023 a mental health levy will be applied to payroll tax to fund mental health and associated services. You may add the value of fringe benefits to regular wages for a payroll period and figure withholding taxes on the total or you may withhold federal income tax on the value of the fringe benefits at the optional flat 22 supplemental wage rate.

Calculating Bi-Weekly Gross Using Annual Salary. Please fill out the form to receive a free copy of our Belgium payroll taxes and benefits guide. For real estate salespersons read Revenue Ruling PTA 025v2.

Find the rates of different taxes excise duties interest rates. When your spouse and children are US. Payroll Tax levied under the Payroll Tax Act 1995 and the Payroll Tax Rates Act 1995 is a tax on all employers self-employed persons and deemed employees on the remuneration paid in their business.

Citizens claiming them on your taxes is simple. Do we know when the 20222023 mandatory annual salary increases. Payroll tax consists of.

Monthly euro conversion rates for calculating Customs. Good Friday is a Christian holiday commemorating the crucifixion of Jesus and his death at CalvaryIt is observed during Holy Week as part of the Paschal TriduumIt is also known as Holy Friday Great Friday Great and Holy Friday also Holy and Great Friday and Black Friday. Automatically calculates Federal Withholding Tax State tax Social Security Medicare Tax and Employer Unemployment Taxes.

Members of many Christian denominations including the Catholic Eastern Orthodox Lutheran. TurboTax Self-Employed Online tax software is the perfect tax solution for independent contractors freelancers and business owners for preparing your income taxes. Every dollar you deserve.

You must pay these payroll taxes to the tax authorities. Terms and conditions may vary and are subject to change without notice. 365 days in a year please use 366 for leap years.

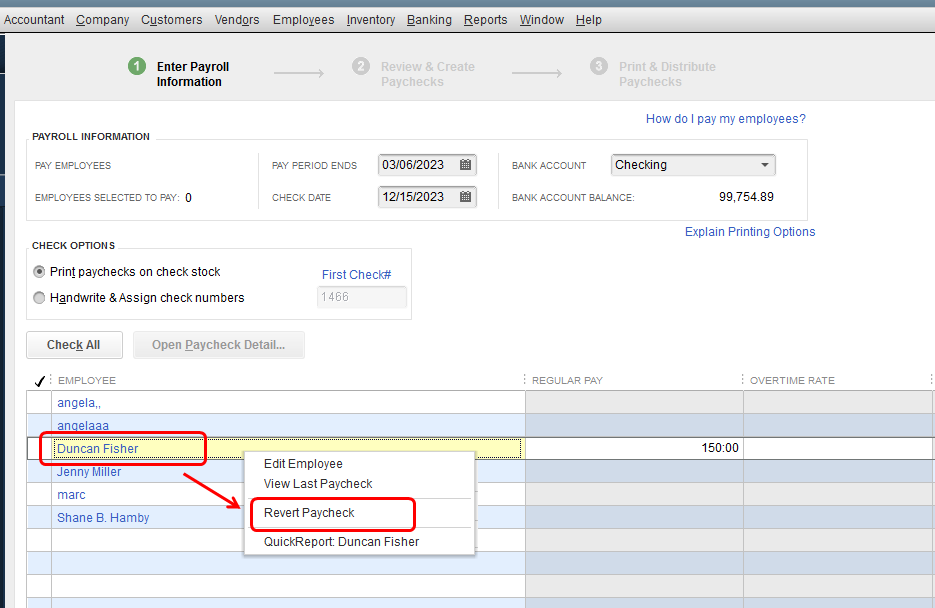

Payroll Taxes and Deductions. As a small or medium-sized business owner it can be challenging to file. In the event of a conflict between the information from the Pay Rate Calculator and the Payroll Management System calculations from the Payroll Management System prevail.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. The above rates are separate from Federal Insurance Contributions Act FICA taxes which fund Social Security and Medicare. Rates and thresholds for employers 2022 to 2023.

You dont need to worry about calculating this when using the simplified method for taking the home office tax deduction. 2022 2023 ezPaycheck single-user version for Windows No CD included The license key will be sent to your email account once. Fixed by municipalities within limits set in the Law on Local Taxes and Fees.

You may consider calculating both methods to help determine which method is best for your situation. Here are the provisions set to affect payroll taxes in 2023. Calculating payroll taxes Dutch Tax and Customs Administration This article is related to.

Taxable remuneration includes the sum of wagessalaries and benefits paid in cash or in kind to employees self-employed persons and deemed employees as a result of services. The gross monthly salary is determined by the average of the last 12 salaries before the employee takes the leave.

2022 Federal State Payroll Tax Rates For Employers

2022 Federal State Payroll Tax Rates For Employers

Payroll Taxes Not Deducted Suddenly

2022 Federal State Payroll Tax Rates For Employers

Social Security What Is The Wage Base For 2023

What Is The Bonus Tax Rate For 2022 Hourly Inc

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

Understanding The Aca Affordability Safe Harbors Health Insurance Coverage Affordable Health Insurance Safe Harbor

Individual Income And Payroll Taxes Tax Foundation

The Latest Payroll News New Zealand 2022 2023 Polyglot Group

2022 Federal Payroll Tax Rates Abacus Payroll

When Are Taxes Due In 2022 Forbes Advisor

Selecting Stock Photos Royalty Free Images Vectors Video Diseno Curriculum Como Hacer Un Curriculum Curriculum

Account Chart Bookkeeping Business Business Tax Deductions Accounting Education

Pin On Truck Driving

2022 2023 Online Payroll Tax Deduction Calculator For 401 K 403 B Plan Withholdings